Executive Summary

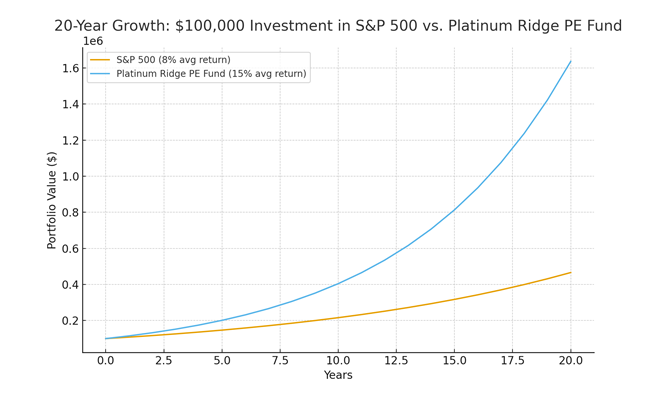

This white paper examines the projected performance of a $100,000 401(k) investment over a 20-year horizon, comparing two strategies:

1. A 100% allocation to the S&P 500.

2. A 100% allocation to the Platinum Ridge Private Equity Fund.

The findings highlight that private equity has a higher target internal rate of return (IRR). It can significantly outperform traditional public market indices when structured for retirement investment.

Investment Assumptions

– Initial Investment: $100,000

– Time Horizon: 20 years

– S&P 500 Average Annual Return: 8% (historic long-term average)

– Platinum Ridge PE Fund Expected Annual Return: 15% (target IRR within fund design)

Results

S&P 500 Investment:

Using an 8% compound annual growth rate:

Final Value after 20 years: $466,096

Platinum Ridge PE Fund Investment:

Using a 15% compound annual growth rate:

Final Value after 20 years: $1,636,654

Comparative Analysis

Cumulative Growth:

– S&P 500: 4.6x initial investment

– Platinum Ridge PE Fund: 16.4x initial investment

Wealth Gap:

After 20 years, the private equity allocation produces an additional $1.17 million in value compared to the S&P 500 strategy.

Implications for Retirement Planning:

– Traditional Market Exposure (S&P 500): Provides steady, lower-volatility growth, historically aligned with U.S. economic performance.

– Private Equity Allocation (Platinum Ridge): Offers enhanced compounding effects, higher return potential, and differentiated exposure compared to public markets.

20-Year Growth Projection

Conclusion

The analysis presents a compelling case. Integrating private equity, such as the Platinum Ridge PE Fund, into retirement portfolios can significantly enhance long-term outcomes. This approach has the potential to quadruple results compared to a traditional S&P 500 index-only strategy. While risks such as illiquidity and valuation transparency must be considered, the long-term wealth creation potential is significant.

Key Insight: A $100,000 401(k) allocation to Platinum Ridge PE Fund could yield nearly $1.64 million after 20 years versus $466,000 in the S&P 500.